The below outlines various scenarios of account adjustments:

Note!

The above account adjustments should only be used for minor adjustments to customer accounts or rounding adjustments (i.e. where the value of the adjustment is less than $10).

We note that no transaction entries regarding the GST implications of these adjustments are recorded in MYOB.

It is recommended that a Void Mode Account Credit transaction be recorded for any transaction adjustments with a value of greater than $10 so that the GST implications and stock adjustments are recorded appropriately in MYOB.

Unallocated adjustments can only be processed when not using the Global Debtor function.

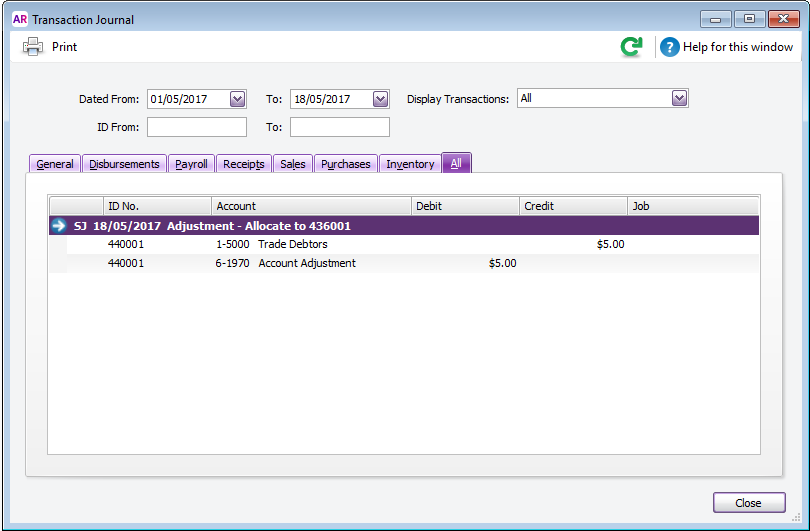

Account Adjustment – Cash & Accrual

A customer has paid less than the full amount of their owing balance and you would like to remove the outstanding amount to adjust the account/invoice to a zero balance.

Account Adjustment – Accrual

(NB. You cannot process Unallocated Transactions or remove overpaid amounts when Global Debtor is NOT activated, therefore this can only be processed when using the accrual method)

A customer has paid more than the full amount of their owing balance and you would like to remove the overpaid amount to adjust the account/invoice to a zero balance.

Transfer account payment – Accrual

You cannot process Unallocated Transactions or remove overpaid amounts when Global Debtor is NOT activated, therefore this can only be processed when using the accrual method

An Account Payment has been applied to the wrong account. You want to adjust the account which the payment was applied to and adjust the account which the payment should have applied to.

Apply discount to customer account

You would like to apply a discount on the account.

As any discount % can only be applied at the time of the initial sale, any discounts applied to customer accounts post the initial transaction, are processed using adjustments.